|

An advantage of benchmarking against McDonald’s is the breadth of info available.

There is real merit in benchmarking your franchisor organization against McDonald’s—as audacious as that sounds.

Benchmarking is a vital best practice process all conscientious franchise systems should undertake. It enables the understanding and development of both franchisor and franchisee performance by comparing actual performance data to a range of dimensions.

There are many possible perspectives to benchmark against, and these can be both internal and external to the business and the franchise network. The following are some of the more obvious and common examples: comparisons to previous time periods; comparisons to budget/targets; comparisons to other franchisees; comparisons to the sector generally.

Clearly these should be the starting point and, managed well, each dimension adds unique insight that can help build understanding, redefine goals and identify improvement opportunities.

But when we’re looking at different benchmarking dimensions, it can be challenging to find relevant external comparisons that really stretch your thinking. So, as a franchise company, why not consider benchmarking your performance against the most successful franchise operation in the world?

Test against the best

McDonaldís net income per store was $164,223. Thatís a BBHAG, for sure, but a 9 percent increase is a score to aspire to.

McDonaldís net income per store was $164,223. Thatís a BBHAG, for sure, but a 9 percent increase is a score to aspire to.An advantage of benchmarking yourself against McDonald’s is the breadth of performance information available. Because it’s a publicly held company, you gain access to considerable performance data on a quarterly basis. And because McDonald’s happens to be one of the world’s most coveted listed public companies, you also get access to the analysis, insight and commentary of the countless financial analysts following McDonald’s stock.

Notwithstanding the BHAG or access to rich information, you may still think the idea is preposterous. And you’d be right if you compare McDonald’s actual revenue, net income or number of locations. Direct comparisons with the corporation’s $27 billion annual revenue and $5.5 billion net income in 2011 (excluding franchised sales, which drive both far higher) or with its 33,510 units, would be insane.

Which key performance indicators are realistic? Fortunately there is a lot you can compare. And the key for most is comparing percentages and ratios. While your profit might be invisible to the naked eye (compared to $5.5 billion), your net income margin might not be. And even if your current profit percentage is anemic by comparison (as will be most), who’s to suggest you shouldn’t shoot for 20 percent as a long-term goal?

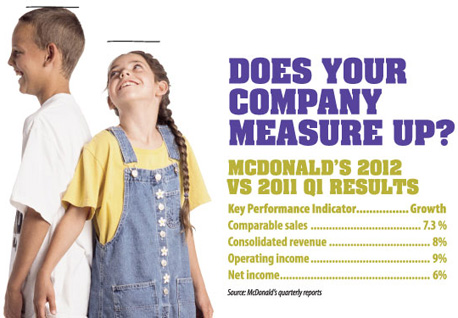

McDonald’s has a number of key performance indicators most companies really should be able to take a crack at on a relative basis. The following (including the aforementioned) are all example KPIs reported quarterly (compared to the same quarter 12 months prior) by McDonald’s.

These measures provide a far more realistic basis for comparison. Indeed, key factors in your favor include two facts: It is much harder for McDonald’s to “move the needle” given their existing scale, and the market for fast food is intensely competitive.

Key factors against you, and thus the challenge and point of this article, are: the consistency within which McDonald’s delivers KPI growth across measures, and McDonald’s clear strategy and sheer commitment and execution upon which they’re based.

The reality is McDonald’s achieves massively via incremental improvements, rather than game-changing one-offs, and on a consistent basis. This is the result of a relentless focus on executing the basics, the rigorous testing of new ideas and initiatives, and fantastic systemwide adaptation.

It is both something to behold, and something to be respected. It is also something we can all learn from and aspire to.

But just to round things off and really depress you, check out McDonald’s Corp.’s net income per store. I just ran the calculation. It was $164,223 in 2011. I think that’s a BBHAG (Beyond a Big Hairy Audacious Goal). But remember, it was $151,092 last year, which means it grew 9 percent. Now that’s something any operator can look to top. |